Small Business Loan(SBL)

These are Loans given to clients who own shops, with their businesses registered in Sierra Leone. The loan is accessed individually and the repayment is monthly.

Group

Special Loans

These are basically for clients who have large businesses but do not have shops, they basically use large tables to display their goods for their customers to buy.

Asset loans

This loan product is for some specific persons who desires the institution to provide for them certain machines/property’s which could help them to generate income on a regular basis.

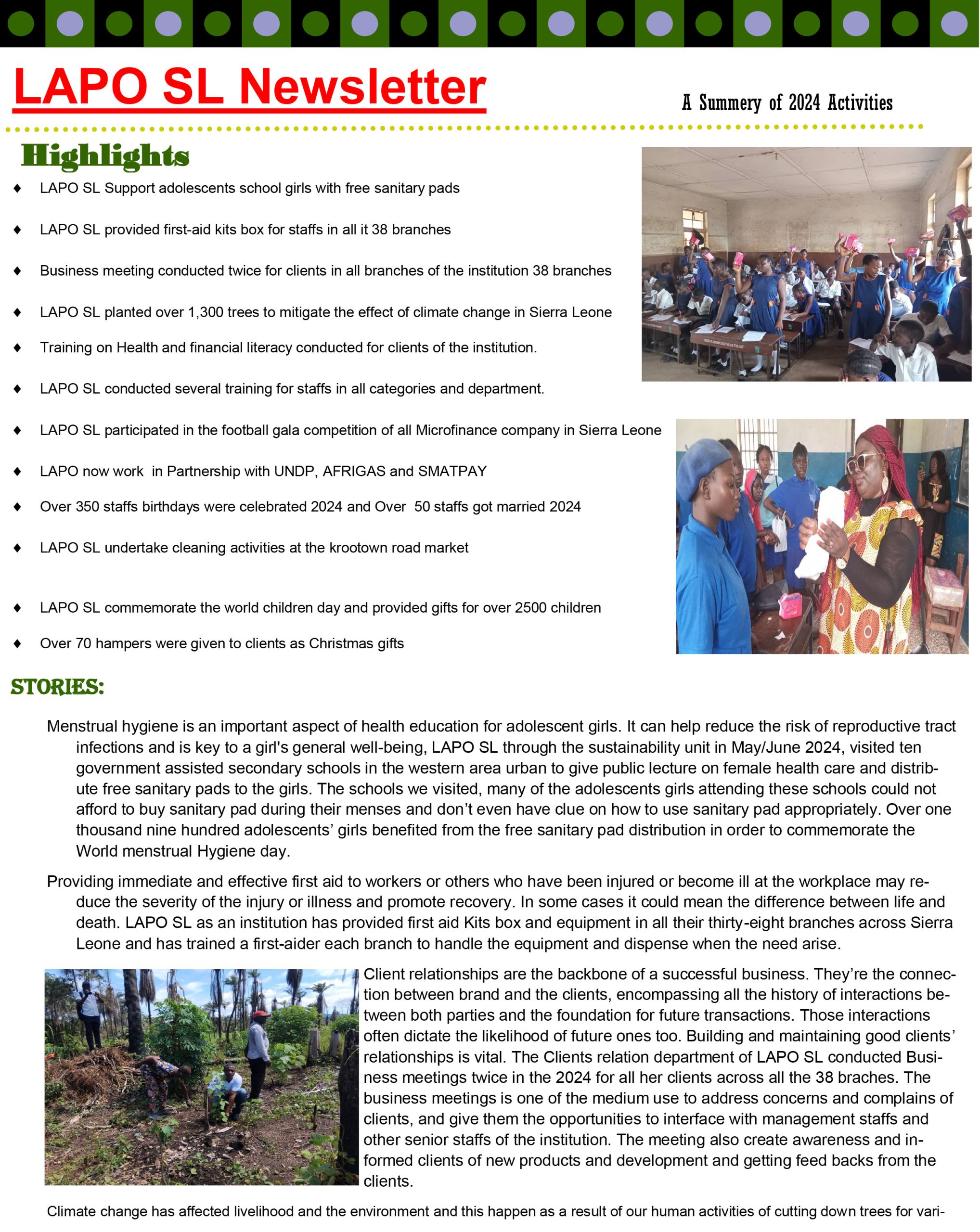

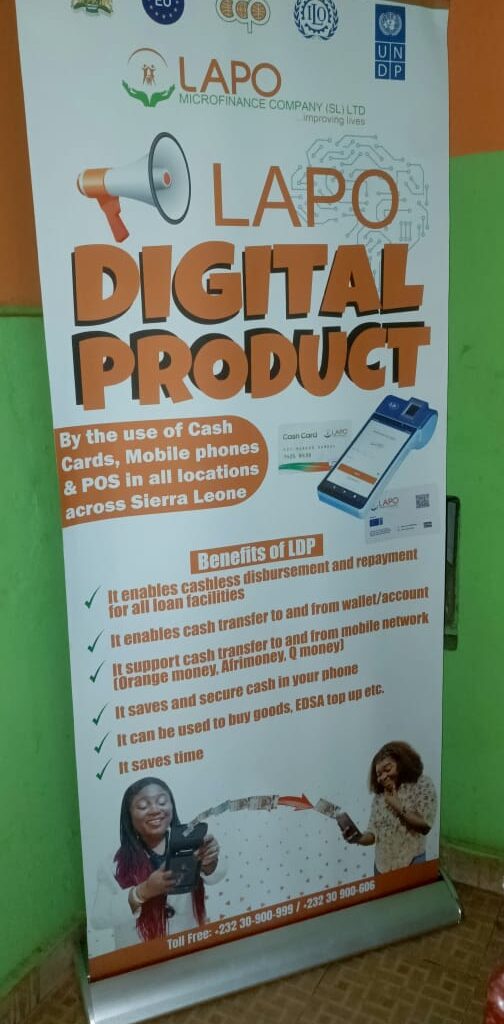

LAPO Digital Electronic Cash Card

Digital Products

Excellence in

LOANS & Savings

Our mission is to offer Financial Services that meet the needs of economically active people in a cost effective and innovative manner.

Testimonial

what the people thinks about us

Since I joined LAPO I have never faced any financial challenge in my business because LAPO has consistently empowered me financially and also helped me develop the business to better stage.

Mrs. Zainab Kamara

Customer

LAPO has improved the business I do through the loans offer to me. As a result, I have been able to pay up my children school fees and render assistant to family members. I also take pleasure to do savings with LAPO because of the good interest I received.

Gibril Bangura

Customer

LAPO has helped me to expand my business due to the loans received from them and has helped me to be financially stable which has resulted to me completing my building project.

Mrs. Marian Koroma

Customer